Moderating inflation, slowing consumer demand, weaker US profit margins, compressed equity risk premium, led to us believe markets will experience the ending of the Fed rate hike cycle (a Fed pause), softer US dollar and a broader consolidation for US equities for 2023.

- We expect inflation to moderate as the economy starts to slow in 2023. While the Fed remains in rate hike mode to tame inflation, we believe the risks are for the Fed to “overshoot” on rate hikes as the realities of slowing demand become more apparent. In our view, Fed fund rate above 5% would be an overshoot and amplify recession risks.

- Cost of capital is no longer cheap relative to growth prospects. Currently, US 2-year yields are 4.25%, 30-year mortgage rate is 6.40% and US yield curve is inverted (10-year yields at 3.50% vs 2-years). An inverted yield curve typically signals a recession, and we believe this should be respected.

How to invest: remain overweight income, increase international equities (vs US), maintain real asset equity exposure, take some profits in real estate.

Asset Class Summary

- Asset Allocation: Overweight income over equities. Current “risk-free” US government bonds are trading at 4.25% (using US 2-year yields) versus current “risky” US equity earnings yields at 5.17%. This translates into a historically small premium of less than 2% for risky assets. Compressed equity risk premium, along with a deteriorating earnings and economic backdrop, speaks for overweighting income versus equities.

- Income: After one of the most aggressive rate hike cycles in memory, there is little doubt that US treasuries are now better priced to address risks than in 2021 when rates were near zero. Within income, we favour high grade fixed income and short to intermediate maturities for value. Our view remains that the US rate hike cycle pauses around 5%. Anything above 5%, in fact, may become more detrimental to productivity gains and economic growth, in our view.

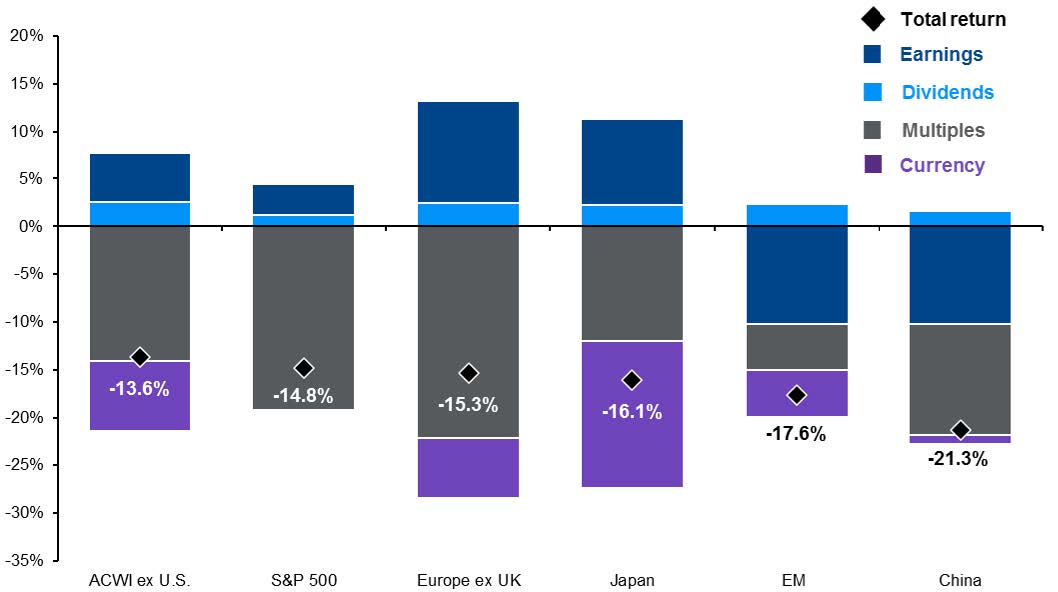

- International Equities: Time to increase international equities vs US. A lot of negativity has been priced into local currencies and international equity multiples (Figure 3). If our base case is right and US yields peak, then the US dollar may have peaked. If that plays out, it is time to consider increasing exposure towards international equities where multiples (forward P/Es) trade around two standard deviations below their historical long-term average vs. US equities which still trade slightly above their long-term historical average. (See International Equities – time to increase equity diversification?)

- US equities: US equity prices remain above what we consider long term fair market value. In our view, S&P 500 closer to 3400 – 3600 would allow us to get closer to neutral weight, (assuming cost of capital peaks below 5% and near-zero GDP growth). We see US profit margins under pressure in 2023. If inflation does moderate, we believe the impact from falling prices on profit margins outweigh any benefit from a more dovish Fed. (See

US Profit Margin pressure continues – Sales, Net Margins and EPS). - Real Assets: In Real Asset Income, time to take some profits on property income and rotate towards alternative and diversifying income managers. As for Real Asset Equities, tight commodity supplies, reopening of China and the accelerated push towards energy independence, argue for continued overweight. (See Real Assets Investing and Road to Carbon Free Economy)

- Alternatives: in Alternative Strategies, we see value in increasing exposure towards distressed and low volatility alternative income managers over long/short equity and trend-following managers. In Private Markets, while higher cost of capital remains a headwind, cheaper multiples offer ideal entry points for investors. We favour continuation, buyout, and mid-market growth equity over venture capital/technology and angel investing.

Wild cards and risks to our base case – Positive market surprises: Putin gets removed or Russia’s War on Ukraine (RWU) ends, inflation falls faster than anticipated or drops. Negative market surprises: RWU escalates, China goes back into lock down, China-Taiwan tensions increase, inflation makes new YOY highs.

Supporting Charts for our 2023 Base case outlook

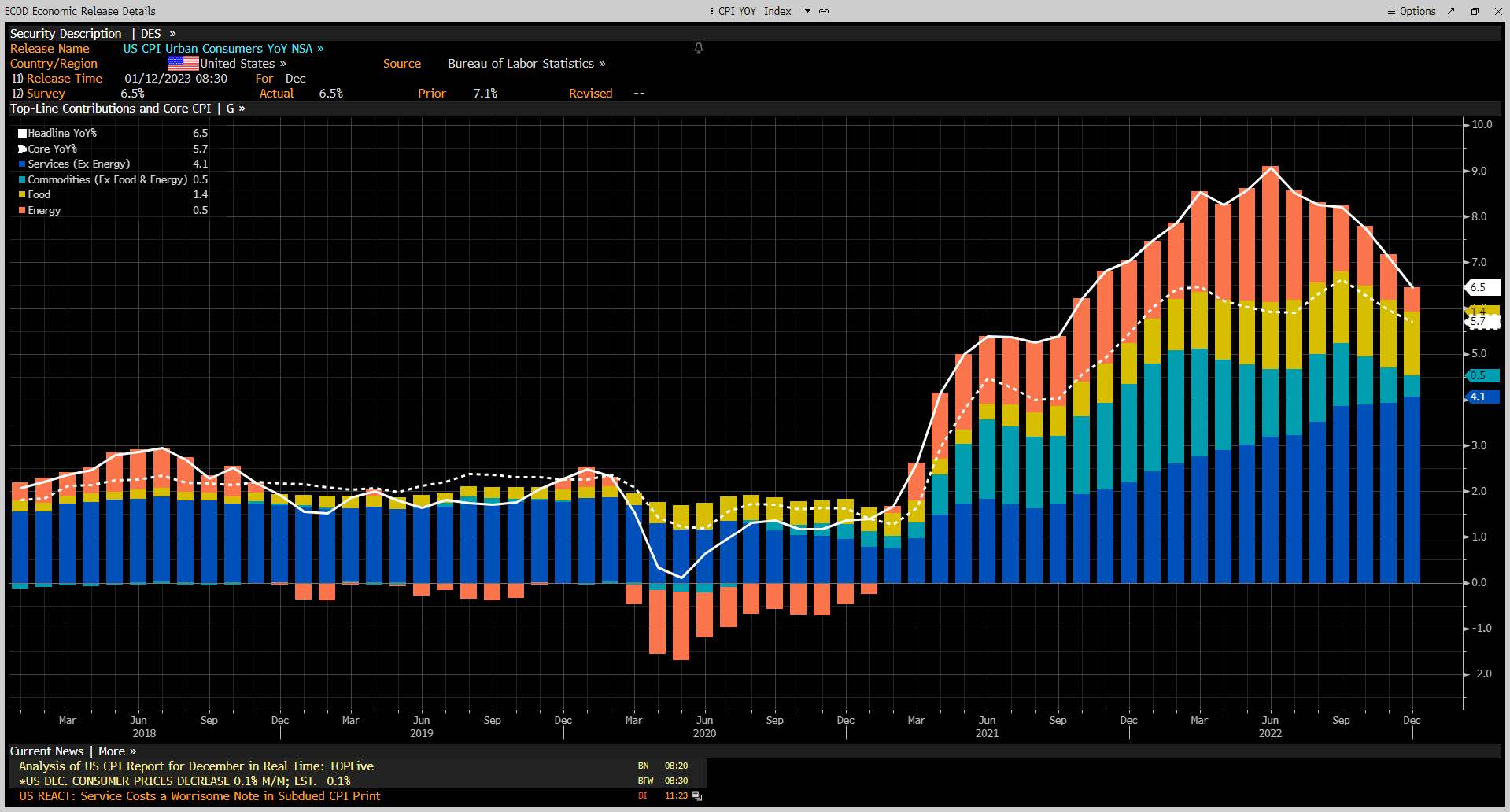

Inflation to moderate – US CPI Index

In our June and November updates, we reiterated our view that we expect inflationary pressures to be offset by growing disinflationary forces as we head into the early part of 2023. Since June, as Figure 1 shows, YOY CPI did in fact peak, with headline CPI peaking in July and Core CPI peaking in September. Interestingly, most of the decline came from energy and commodities, while food and service inflation are facing more persistent headwinds.

Figure 1: US Inflation – US CPI YOY NSA. Source: Bloomberg

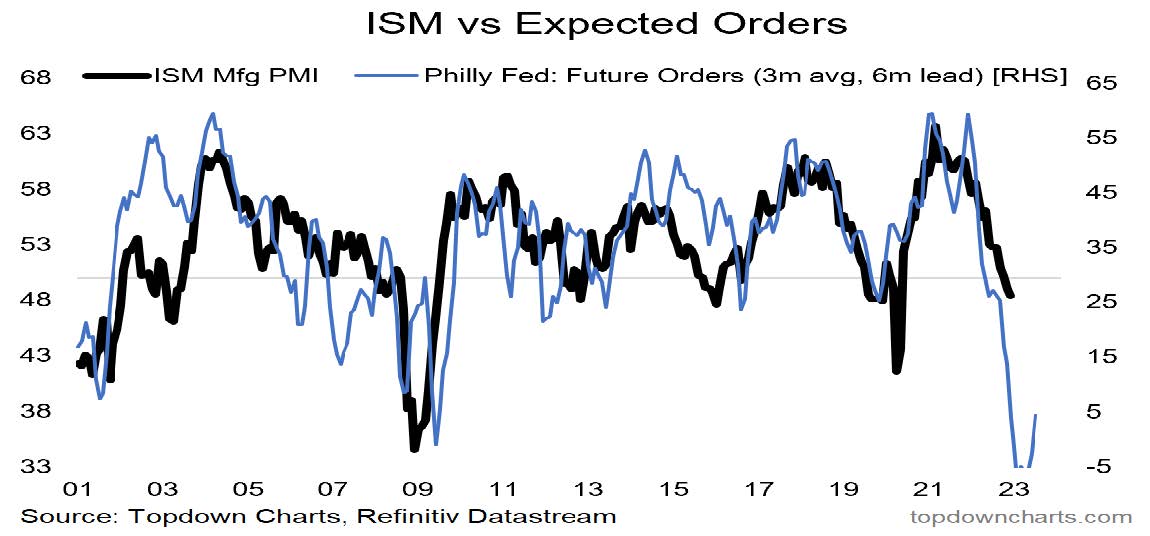

Economic growth to weaken – ISM Manufacturing, Expected Orders

Figure 2 shows two leading indicators, ISM Manufacturing PMI and Expected Orders. The latest move down in the ISM manufacturing PMI (and even sharper drop in services PMI), supports our base case scenario of increasing disinflationary pressures and may lead to an economic slowdown in 2023. Other leading indicators (including a steeply inverted yield curve) point to a similar path of declining growth.

Figure 2: ISM Manufacturing, Philly Fed expected orders both indicating top line headwinds for US revenues. Source: Topdown Charts, Refinitiv Datastream.

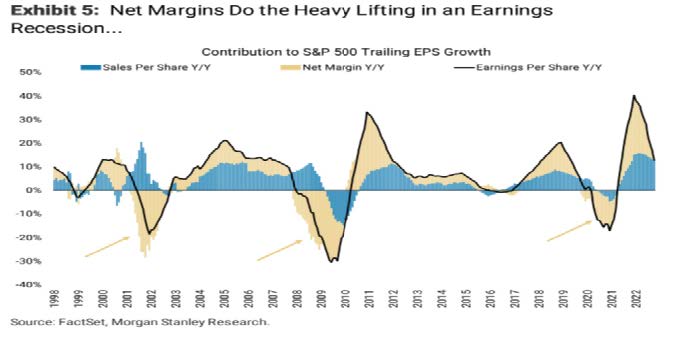

US Profit Margin pressure continues – Sales, Net Margins and EPS

Corporate sales don’t have to fall much to pressure margins. Since most companies have some level of fixed costs, even a mild recession can cause topline to amplify the swings on margins, (as Morgan Stanley notes in their research and graph below). If inflation does moderate this year, as we expect, then falling prices, coupled with falling volume may have more impact than the benefit of a “less hawkish” Fed.

Figure 3: US Profit Margins and Contributions to earnings. Source: Morgan Stanley Research, FactSet.

International Equities – time to increase equity diversification?

Multiple contraction and local currency weakness has been a drag on international equity total returns. We believe this provides as good of an entry point (as any) to increase diversification via international equities for long-term investors.

Figure 4: 2022 YTD Total Returns across equity markets and net contributions. Source, JPMorgan Asset Management, MSCI, Standard & Poor’s.

Real Assets Investing and Road to a Carbon Free Economy

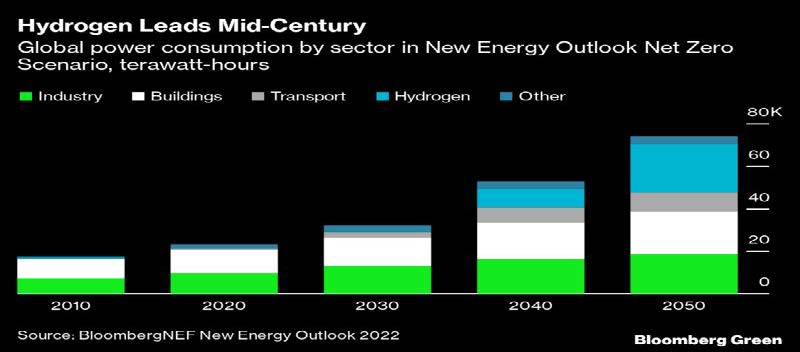

Russia’s War on Ukraine (RWU) has not just ramped up Europe’s ambition for renewable energy, but it is rewiring global capital flows to countries who have easy access to sun and wind as they compete to becoming the lowest cost provider of different forms of clean energy.

On the African Continent, RMI think tank believes Africa has access to 39% of global renewable energy potential. UN Secretary General stated in his 5-point Plan for transitioning to renewables “we need to invest up to $4 trillion in renewable energy projects.” His concern, Africa, where they have substantial renewable energy potential, yet only receive 2% of the clean energy investments.

This is helping fuel the collaboration with Africa and Europe on carbon and clean energy matters. ENIs CEO Descalzi describes this as the new South-North Axis where “Africa has the energy; Europe has the industry”. Capital investments to Africa have grown significantly since the onset of RWU.

Down south, Chile is betting big on the Patagonia winds and solar in the Atacama desert. In collaboration with international firms, from Siemens Energy, Exxon Mobil to Porsche, mining and engineering companies, they have built the world’s first integrated, commercial, industrial scale plant (Haru Oni) for making synthetic climate-neutral fuels (a substance that is chemical identical to gasoline) and green hydrogen. This new business innovation model that integrates green energy, molecule production, is attracting secondary industries to be located nearby. While Haru Oni is still a pilot, Haru Oni, along with Chile’s massive solar farms in the Atacama desert, Chile’s undersecretary of energy expects exports of hydrogen, synthetic fuels to add up to $24 billion per year by mid-century.

Already, China is focused on green hydrogen as the lead clean energy fuel and are seeking to control hydrogen energy and eclipse western rivals through their dominance in electrolyzers, a key piece in the next generation of clean energy.

In the new Era of Hydrogen and Clean Energy where access to wind and solar are key, countries that were once long bypassed in today’s petrol-dollar world, their importance is growing with the changing climate.

Figure 5: Forecast where Hydrogen leads global power consumption by mid century

Conclusion

Deutsche Bank rightly point out that 2022 is a year for the history books in terms of market performance. Both S&P 500 and the 10-year US treasury bond lost more than 10% on a total return basis. Outside of 1982, (extreme positive year), 2022 (extreme negative year) is the biggest outlier since 1872.

In 2022, our recommendations remained defensive. Today, US treasuries are far better priced than they were at the beginning of 2022. We see 2023 as a year for income generation and a transition year for US equities. It is a year in which investors take advantage of current income yields, while waiting to fade into better equity opportunities at levels where we consider present more reasonable, longer term fundamental value.

We remain bullish on the longer-term prospects for Real Assets but there are risks that investors should consider before investing as well as challenges. Given the ramp towards European ambition to energy independence, and the US Inflation Protection Act, we continue to believe the Real Asset exposure will offer opportunities to optimize portfolios for long term resiliency.

We look forward to speaking with you soon!